Business

Gulf Overtakes North America In Remittances To India

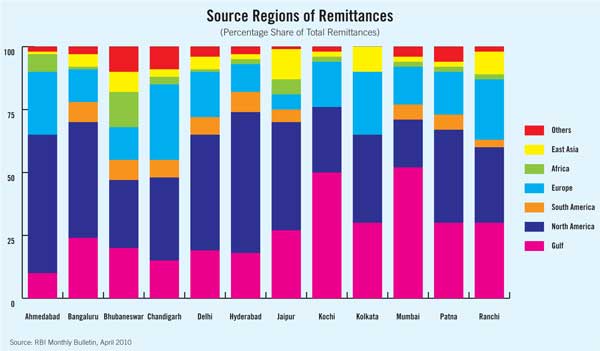

The share of remittances from the Gulf regions grew during the global economic crisis in 2008-2009 and declined from North America and East Asia.

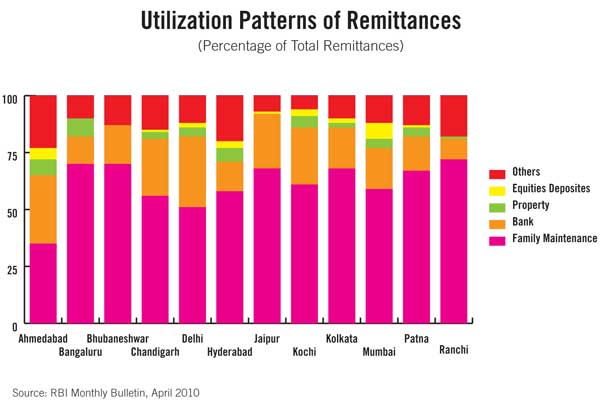

| Nearly 61 percent of remittances to India are used for family maintenance, according to a new Reserve Bank of India study. Another 20 percent are deposited in banks and just 4 percent are used for Real Estate and 3 percent for equity investments. In a reflection of the global economic crisis, the study found that the proportion of remittances invested in 2009 in property and equities (7 percent) declined sharply from 2006, when they accounted for 20 to 25 percent of all remittances.

Utilization patters varied significantly cross the country, according to the April 2010 RBI study, titled “Remittances from Overseas Indians: Modes of Transfer, Transaction Cost and Time Taken.” The use of remittances for family maintenance, most commonly food, health services and education, was lowest in Ahmedabad (35%) and highest in Ranchi (72%), Bangaluru (70%) and Bhubaneshwar (70%). Relatively higher proportions of remittances were banked in Delhi (31%), Ahmedabad (30%) and Kochi (25%). Higher proportions of remittances were invested in property and equities in Ahmedabad (12%), Mumbai (11%), Hyderabad (9%) and Bangaluru (8%).

Kochi and Mumbai receive more than half their remittances from the Gulf. By contrast, Ahmedabad, Bangaluru, Chandigarh, Delhi, Hyderabad and Kolkata received more than 60 per cent of their remittances from North America and Europe. Nearly 42 percent of the remittances by volume were for amounts greater than Rs 50,000 ($1100) while 30 percent were for amounts under Rs 10,000 ($225). Higher value remittances were concentrated in Ahmedabad, Bhubaneswar, Chandigarh, Delhi and Jaipur, while lower value remittances were concentrated in Bangaluru, Kochi, Kolkata, Mumbai, Patna and Ranchi.

Nearly 42 percent of the remittances are received monthly and nearly two-thirds at least once a quarter. The RBI study found an inverse relationship between size and frequency of remittances. “This broadly indicates that the centers which receive remittances of smaller magnitudes, receive them more frequently and are generally meant for family maintenance,” it concluded. The study, conducted in November 2009, found that “inward remittances in India have not been impacted significantly by the global economic crisis.” It attributed this to the depreciation of the rupee and the hike in interest rates on NRI accounts “which might have induced the workers to remit their money to India as a hedging mechanism due to relatively better growth prospects.”

|

You must be logged in to post a comment Login